Weekend Reads

Inflation and Public/Private Growth Stock Data

I have been out of a commission for the last couple of days from my blog. My early morning rambling sessions have been interrupted by the dubious COVID-19. Luckily it is nothing more than some sniffles in terms of symptoms for me. Stacy and the twins also have it but Sophia seems to be COVID-immune so far (knock on wood.)

There has been some interesting content that has been coming out regarding the volatile growth sector, inflation data, public/private comps, and some VC fund performance data.

My friend Aashay writes on market Gyrations on his substack. Great ways to think about market volatility as a private market investor.

RAISE, an association for emerging VC managers posted this Infograph regarding a survey of 250 managers fund makeup and performance. I am curious to see how performance is going to be next year.

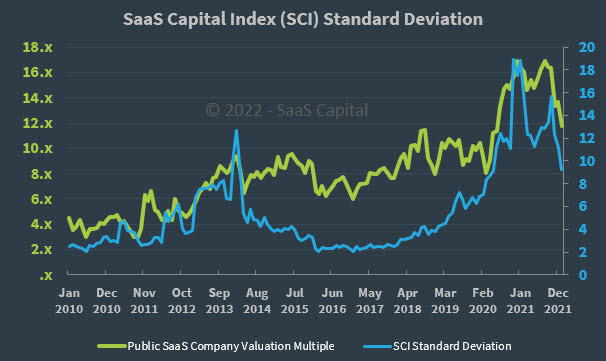

The SaaS Capital Index is showing an estimation of a 30-50% discount of private market valuations to public market comps. Everyone seems to have a story of what they are and I have yet to really understand what is going on in this funding environment.

Capital Stack:

This week we launched a new episode of the Capital Stack with Jerry Pence of Balanced Capital Partners on how PE Is Bull$hit, Recovering From the First Deal Going Flat, and Humility in Investing. Listen to it here on Apple and Spotify.