The Rise of "Early Growth Equity": A Game-Changer for Startups

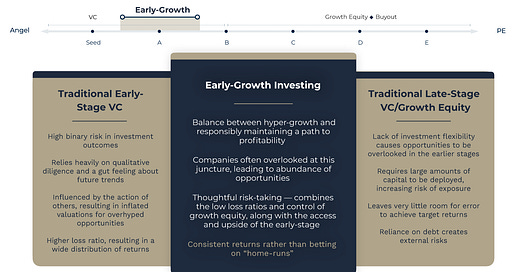

As a founder, it is imperative to understand the different types of early-stage capital available, the return requirements of each capital stack, and the success metrics set by investors. Many early-stage VCs have similar requirements, pushing for a return of 100x on each deal. However, a new category of early growth equity has emerged, enabling founders to have more optionality and get a chance to sell on the way up. In this blog, we explore the types of early-stage capital available and the importance of understanding their different requirements.

Portfolio Construction

When seeking early-stage capital, founders must understand the portfolio construction of each investor. Some investors are focused on specific verticals, such as biotech, fintech, or B2B SaaS. Founders should look for investors who have expertise and significant experience in their particular industry or vertical. Investors with a diverse portfolio of companies, including successful exits, are more likely to provide better support and guidance to their portfolio companies.

Return Profile

Investors are usually looking for a specific return profile on their investments. Traditional early-stage VCs usually require a 100x return on their investment, while early growth equity funds aim to achieve a return of 4-6x in 4-6 years. Founders should be aware of these requirements before accepting the investment, as it affects future funding rounds and the potential for early partial exits.

Success Metrics

Founders should also understand the metrics used by investors to measure success. Some investors prioritize rapid growth and market share, while others focus on sustainable growth and profitability. Founders should choose investors whose priorities align with their own goals and objectives, as it will prevent conflicts and misunderstandings in the future.

Early Growth Equity

Early growth equity sits between early-stage VC and late-stage growth equity in terms of return requirements and risk profile. These funds aim to achieve a 4-6x return on their investment, with a lower loss rate and burn profile, leading to more cash efficiency. Early growth equity funds enable founders to have more optionality and better control over future fundraising rounds and potential exits.

Optionality

Founders should always seek optionality when seeking early-stage capital. This means looking for investors who provide opportunities for growth and secondary exits, enabling the founders and early-stage investors to sell on the way up. Revenue-based financing and other alternative financing options can also offer startups flexibility, enabling them to raise funds without diluting their equity or giving up board control.

Conclusion:

As a founder, it is crucial to understand the different types of early-stage capital available, including traditional early-stage VC and early growth equity. Founders should consider portfolio construction, return profile, and success metrics when choosing an investor, ensuring they have mutual goals and objectives. Early growth equity funds provide founders with more optionality and control over their fundraising and exit strategies. Founders should seek optionality to enable them to grow their company in the best possible way without sacrificing control or diluting their equity.