The Nursing Shortage Crises: A Serious Venture Opportunity?

It’s no secret that the United States is facing a shortage of nurses that has been growing steadily over the past decade. According to the American Nurses Association, the U.S. is short around 200,000 RNs and could be short as many as 1 million by 2030. But what if I told you that this shortage presents a unique venture opportunity for founders and investors alike? There have been droves of startups racing to solve this problem. We are seeing workflow, educational simulators, as well as gig economy solutions. Who is going to solve this problem? Keep reading for my opinions.

The Problem:

The aging US population is one major factor contributing to the nursing shortage. As Baby Boomers continue to enter retirement age, they are increasing their need for healthcare services like long-term care and home health assistance. Unfortunately, there isn’t enough qualified nursing personnel to meet this growing demand.

Compounding matters further is a shift in perception around the profession of nursing. Nurses face higher rates of burnout than other healthcare professionals given their long hours on the job and intense workloads. This has led many nurses to seek out alternative careers with more flexible schedules or better compensation packages. On top of this, some potential nursing students are discouraged from entering the field due to perceptions that nurses lack autonomy or decision-making power compared to other medical professionals.

Ultimately, if these underlying challenges influencing the nursing shortage remain unaddressed then it will be difficult for hospitals across the nation to adequately fill positions with sufficient numbers of skilled RNs capable of providing quality patient care in our increasingly complex healthcare environment. Therefore, it’s essential that policymakers not only understand the causes of this critical problem but also develop effective strategies that address them in order to make progress toward eliminating it once and for all.

The labor shortage in healthcare has had a devastating effect on hospitals' financials. With fewer qualified nurses and other medical staff available, healthcare facilities have had difficulty meeting their staffing needs, leading to increased operating costs and decreased efficiency. As a result, the cost of delivering care has gone up significantly, causing many hospitals to take on large amounts of debt or reduce services to stay afloat. In addition, the lack of nurses has put an extra burden on existing staff which can lead to burnout and higher turnover rates that also contribute to an increase in operational costs for hospitals. Finally, since most states rely heavily on Medicaid reimbursements for covering hospital expenses, the labor shortage is contributing significantly to reduced reimbursement rates as fewer qualified workers are available to treat patients who often have complex health issues requiring specialized care. Consequently, this has led many hospitals with already thin margins into losses that could become even worse if meaningful solutions aren't adopted soon.

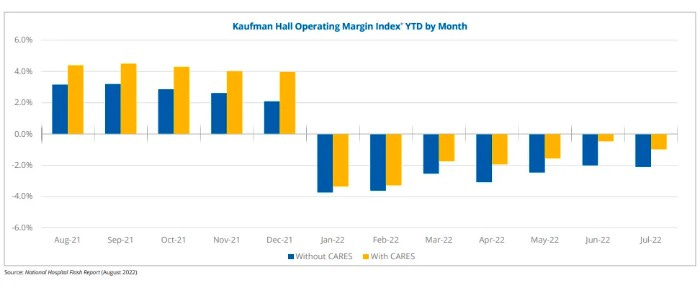

Kaufman Hall finds that hospitals’ already razor thin operating margins have cratered 700bps since 2020 into consistent negative territory, largely driven by labor expenses, which represent the largest

component of hospital opex, rising 16% since 2020

The Current Technology Landscape

Several venture-backed companies are addressing the nursing shortage problem- in my market map, I have segmented these companies into five categories: marketplaces/gig, virtual nursing, HR workforce platforms, clinical placement, and up-skilling/re-skilling.

Marketplaces/Gig:

These companies have absorbed most of the venture dollars and have shown to have the most traction within healthcare organizations- at least for the time being. These companies offer a marketplace or 'gig' like platform, where nurses and other healthcare professionals can find short-term jobs, typically lasting several hours or days. These platforms make it easier for organizations to fill open shifts quickly and also make it simpler for workers to match with suitable positions. The problem with these solutions is that you are just shuffling around a finite resource. Additionally, it could be cannibalizing your existing workforce by pulling already employed nurses onto the platform. Examples of these platforms include Incredible Health, ShiftMed, and Directshift.

Virtual Nursing:

Virtual nursing technologies are beginning to become more widely used in the healthcare industry as telecommunication technologies have improved. Virtual nursing services give hospitals the ability to connect with remote nurses who have the same qualifications and certifications as those working onsite. By leveraging virtual nursing services, hospitals can reduce their need for additional permanent staff and decrease labor costs associated with hiring full-time employees. Think of having tablets in all of the patient rooms to do time-consuming activities that do not need face-to-face interactions - I.e. medicine reconciliations and nursing assessments. Good examples of virtual nursing platforms include SteadyMed andAvaSure in the hospital setting. There are now more verticalized solutions like Probari which focuses on skilled nursing and LTC facilities.

HR Workforce Platforms:

HR workforce platforms are designed to help hospitals reduce the burden of managing their nursing staff as well as other core horizontal labor workflows. These platforms offer a range of tools and services, such as scheduling, compliance tracking, payroll management, and more. By streamlining the process of managing nurses' paperwork, schedules, and other personnel tasks, these platforms can free up resources that can be used for other activities. The more broad platforms include HealthStream and MedTrainer which focus on training, compliance, and credentialing. Another common category of HR platforms in this category is VMS (vendor management systems) which track the hospital's ability to contract with third-party nursing agencies. Such platforms include BlueSky and Shiftwise. Some of the new incumbents in the space that focus on shift forecasting and utilization include LeenTaas and DropStat.

Clinical Placement:

Clinical placement companies specialize in helping hospitals fill long-term staffing needs indirectly by connecting them with qualified nursing students to complete their clinical training. These companies often have access to large networks of schools or nursing students that they can tap into to match with the right training opportunities. This category is in my opinion the most open for disruption as it is dominated by only a few legacy players including Acemapp, EXXATT, and Castebranch.

Up-skilling/Re-skilling Platforms:

These companies are focused on helping nurses and other healthcare workers to upskill or re-skill so they can transition into other roles or take on additional responsibilities. These services typically involve training programs, like online courses or workshops, that help individuals stay abreast of new developments in their fields. They may also provide career counseling services to help job seekers navigate the job market and find the right fit. Examples of these services include EmpiricaLab (technology upskilling), ElemenoHealth (point of care P&P), and EnGen (language upskilling). In some cases, there are also verticalized training solutions such as ConquerExperience which focuses on clinical and non-clinical roles in a clinical setting using virtual reality simulation.

Conclusion:

After reviewing several categories and companies in this space I believe the one that is going to win this category is going to be bridging the gap between nursing schools, hospital preceptorships, and hospitals. The two companies that I see working with all of these institutions in a meaningful way with a managed service and technology component are Simpliphy and Davin Healthcare. They both take the position of being an outsourced training team that will work with the hospital system in bringing in FT nurses while also managing the "weening off" of the traveling nurses. I am not sure how this could be a complete SaaS play which is the reason why there aren't that many venture-backed companies addressing the problem with this managed service approach.

However, I believe that these companies have an edge as they are creating a unique offering and an ability to scale quickly. This vertical would be ripe for a platform or technology solution that could be used in hospitals across the country. Ultimately, this is one of the areas of healthcare staffing where there could be major changes to come. It will be interesting to see who will win the race.

Thanks for reading! :)