Q2 2023 Deal Intelligence

It's quite astonishing that we've already surpassed the first half of 2023. COVID-19 appears to be a distant memory, shifting the focus now to the aftermath of the global pandemic and its economic repercussions. In 2022, the United States witnessed the fastest rise in interest rates, followed by a more moderate acceleration in 2023. As of now, WSJ Prime rates have settled at 8.25%, while mortgages are hovering above 7%.

These giant shifts in macroeconomics have reverberated a great deal in both the public and private markets (which we will speak about below). Everyone saw the headlines of the collapse of Silicon Valley Bank and other regional players. It is only obvious that commercial real-estate, specifically in the core office, is about to go through a bloody gauntlet.

Despite the big shifts in rates there emerged a big platform shift. Artificial intelligence, particularly in the context of Learning Language Models (LLMs), has become the latest trend in the venture ecosystem. It seems like everyone has an AI strategy these days. However, it can be challenging to determine the defensibility of these programs beyond the general application layer. While I am optimistic about the technology, I remain skeptical about relying solely on an incumbent's AI functionality to replace a larger platform. In my opinion, LLMs are more like a feature within a product rather than a standalone solution. Only time will reveal their true potential. In order for me to get excited about a generative AI application it must meet two criteria 1) have a proprietary dataset 2) must be completely integrated with customers’ existing digital workflow.

Public Market Overview:

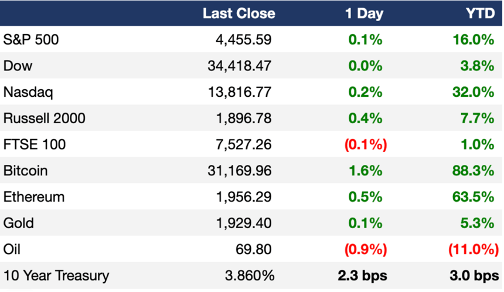

The markets continue to rise this year as it appears that the higher interest rate is having the desired effect on the economy. Inflation had a CPI print of 3% this last month which has been a pretty incredible drop from over 4% the previous month. Wages still are high and so is the participation rate. It seems that all the major analysts are changing their view about the looming recession and are now touting a soft landing. I’ll leave macroeconomic predications to the smart people. I am just looking for the best companies.

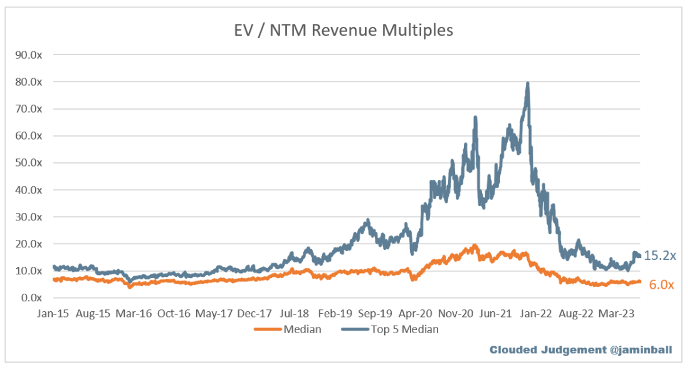

In the SaaS world, the median EV/NTM is at 6x, up from 5.5x last quarter. This is selling at roughly a 15% discount from the trailing seven-year average of 7.8x EV/NTM. Most of these software stocks are unprofitable and are not considered the main drivers of the NASDAQ growth. The stock indices are heavily weighted to NVIDIA, Apple, Google, Tesla, and Facebook which have been ripping this year.

Private Market Overview:

When I began investing in startups in 2015, we could invest in $1M+ Annual Recurring Revenue (ARR) for around 7-10x their current ARR. However, during the peak of 2021, companies with less than $1M ARR were getting post money valuations of $15M. It seems that trend is shifting, although we now find ourselves in the challenging phase of managing cap tables. It's no easy task. Investors must approach their entry points with great caution due to the evident multiple compression in later stages.

Based on the anecdotal evidence and data I've come across, A++ assets still command valuation multiples of 10x-15x, while other SaaS companies typically range from 4x-6x. Identifying an A++ asset requires careful consideration. It should demonstrate 200-300% growth, 100%+ net dollar retention, a burn multiple of less than 3x, CAC payback of less than 1 year, and a sizable addressable market. Personally, I'm more pragmatic than optimistic when it comes to my own companies reaching these metrics, so I'll remain highly conscious of valuations.

One major concern I have regarding the private capital markets is the apparent lack of engagement from limited partners. The current growth slowdown has resulted in a stagnation of capital circulation, causing liquidity problems for institutions and family offices. In response, top-tier venture funds have begun raising smaller funds and lowering fees to appeal to institutional investors. This represents a significant deviation from the situation just two years ago.

If you want to receive the full copy of DWP Capital’s deal intelligence that includes deal flow and valuation data reply to this email asking to opt in!