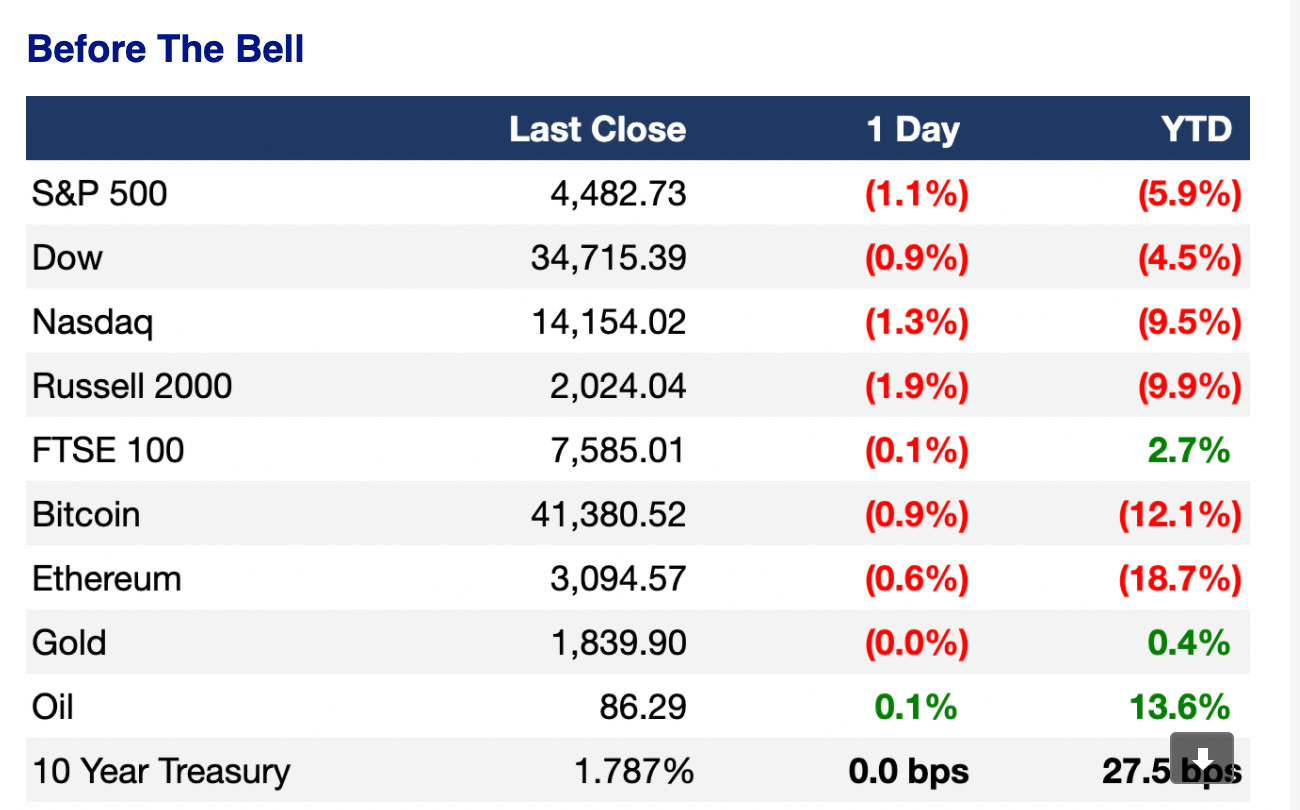

Picture below from the Litquidity Newsletter.

God giveth and God taketh away….

That at least is the current sentiment of growth stocks. We have seen some incredible volatility and sell-offs in everything technology-related. Where is money flocking? - it looks like Oil and more popular value names. I don’t believe that Charles Schwab and Exxon Mobile will be the future of the world. I’m not selling.

I listened to the Ted Seides Capital Allocators Podcast with guest speaker Chris Douvos. Chris referenced the pricing of internet stocks with a quote from John Doer right before 2001 .Com crash.

“The internet is overvalued in the short term but is undervalued over the long term.”

Every action seems to be a reaction over the last three years. So watching this show is very interesting!