Don't Get Full on the Salad Bar- The Good Assets Have Yet to Avail Themselves

I have spoken to several investors over the last 18 months regarding the quality of their deal flow. They have all universally told me that it is mediocre at best. This is because all the good assets took huge rounds in 2021, and if the CEO was smart, they leaned out to grow into their valuations. One such example I have heard was an investor saying he had a $3M ARR cyber security company that raised $60M and now has seven years of runway.

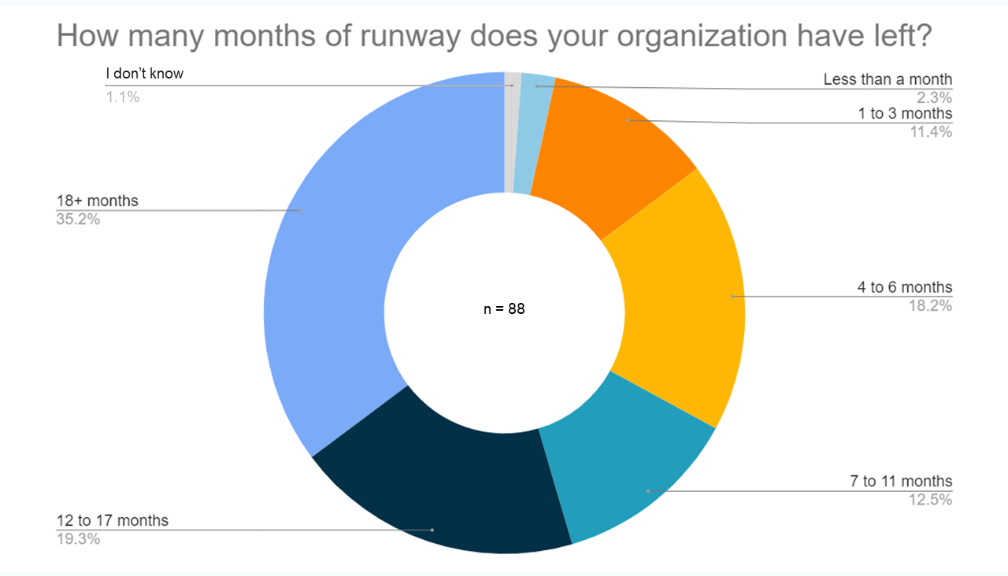

The ones that do need capital are getting bridged internally. One such A+ asset is Mantra Health, which raised a Series A extension today of $5M. That's a huge extension. The question will be when the existing investors are tapped out of commitments, and the companies need to return to the market to get re-valued. How much runway do these guys/gals have? There was an exciting study in HealthTech Nerds about the amount of runway of startups in their community.

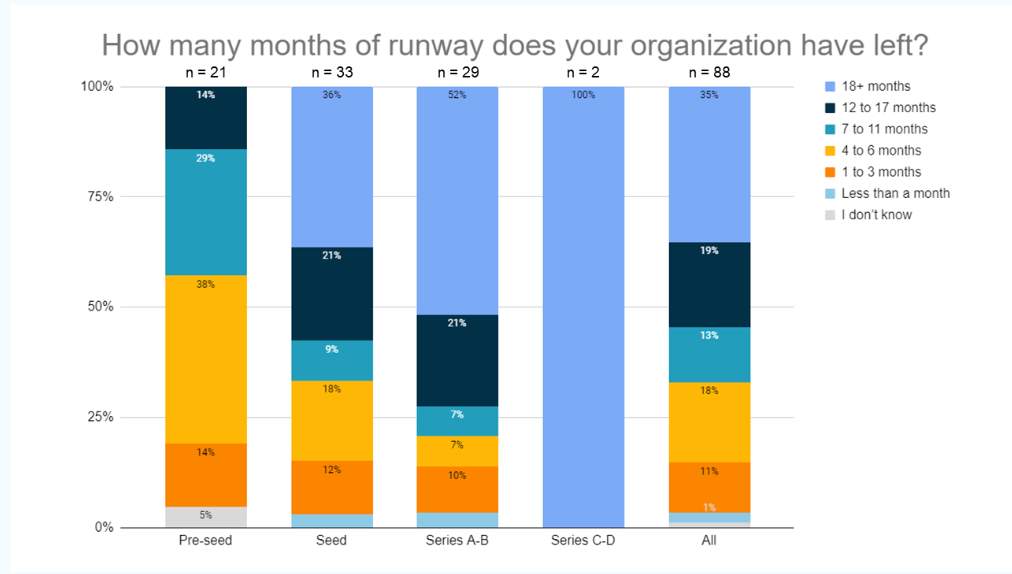

The following chart is runway by stage.

This sample size of n=88 is not indicative of the whole market but is an interesting signal that we might have 9-12 more months before we start seeing the good stuff again.